Critical analysis of unconditional basic income and its effect on labor market and tax revenues – Bc. Yi Yang

Bc. Yi Yang

Master's thesis

Critical analysis of unconditional basic income and its effect on labor market and tax revenues

Abstract:

The aim of the author's thesis is to investigate the positive and negative consequences of the implementation of Unconditional Basic Income (UBI) in selected economic scenarios, as well as to find out which factors affect the labour market and tax revenues in the region in the context of UBI. The economic scenario chosen for this thesis is Macau, China, and it is studied in relation to a similar unconditional …more

Language used: English

Date on which the thesis was submitted / produced: 4. 4. 2024

Thesis defence

- Date of defence: 30. 5. 2024

- Supervisor: Ing. Lukáš Moravec, Ph.D.

- Reader: Viktor Janáček, Ing., externi

Citation record

ISO 690-compliant citation record:

YANG, Yi. \textit{Critical analysis of unconditional basic income and its effect on labor market and tax revenues}. Online. Master's thesis. Praha: Czech University of Life Sciences Prague, Faculty of Economics and Management. 2024. Available from: https://theses.cz/id/usfvuq/.

Full text of thesis

Contents of on-line thesis archive

Published in Theses:- světu

Other ways of accessing the text

Institution archiving the thesis and making it accessible: Česká zemědělská univerzita v Praze, Provozně ekonomická fakultaCzech University of Life Sciences Prague

Faculty of Economics and ManagementMaster programme:

Economics and Management

Theses on a related topic

-

Critical analysis of unconditional basic income and its effect on labor market

Evgenii Galkin -

Marijuana Legalization and taxation: Approaches of states from the perspective of public finances.

Serena Iglina -

The relationship of income taxation, social benefits and motivation to work in Czechia

Eliška Challise -

Immovable Property Taxation Reforms

Veronika Kvapilová -

Behavioural Economics and taxation: a perspective on tobacco consumption and tobacco tax

Andrea Bruni -

Value Creation as The New Taxation Standard in The Global Digital Economy

Petr Vodák -

Supply Chain and Legal Regulation of its International Taxation

Marek Škultéty -

The Role of Digitalisation in Fair Taxation

Tina Krieger

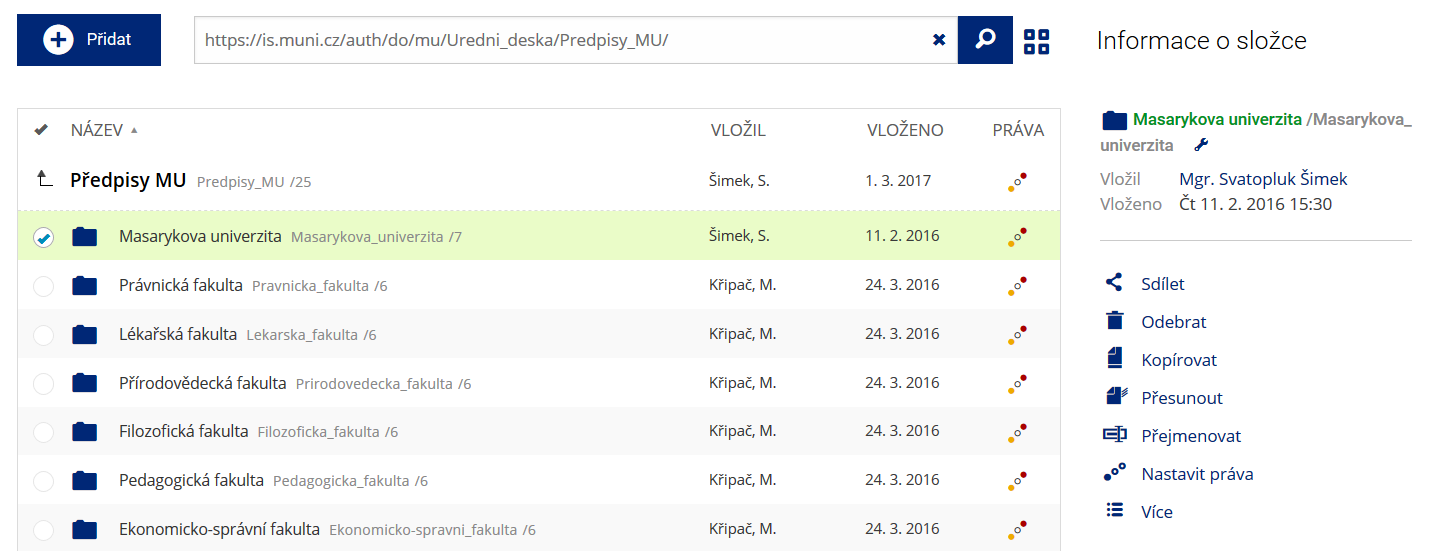

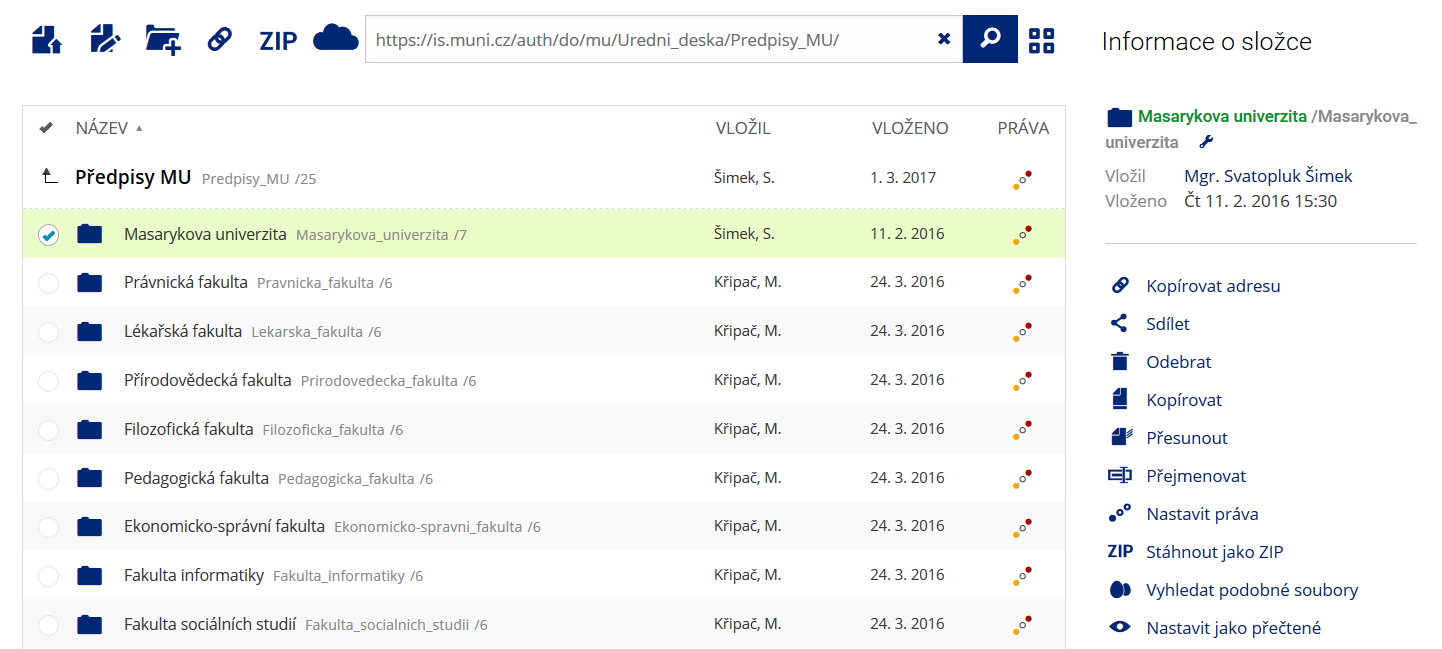

Name

Posted by

Uploaded/Created

Rights